“The ‘World Payments Report 2023,’ conducted by Capgemini, is a comprehensive analysis of the global payment industry, shedding light on current and future trends.

In the post-pandemic context, the payment sector has demonstrated remarkable resilience, with an increasing adoption of digital payment systems by consumers, small businesses, and large enterprises.

Here is an enriched summary of the key trends highlighted in this study:

1. Shift in Payment Sector Focus

– Historically centered on retail payments, the report now underscores a significant opportunity for banks and Payment Service Providers (PSPs) to support corporate treasuries and commercial businesses.

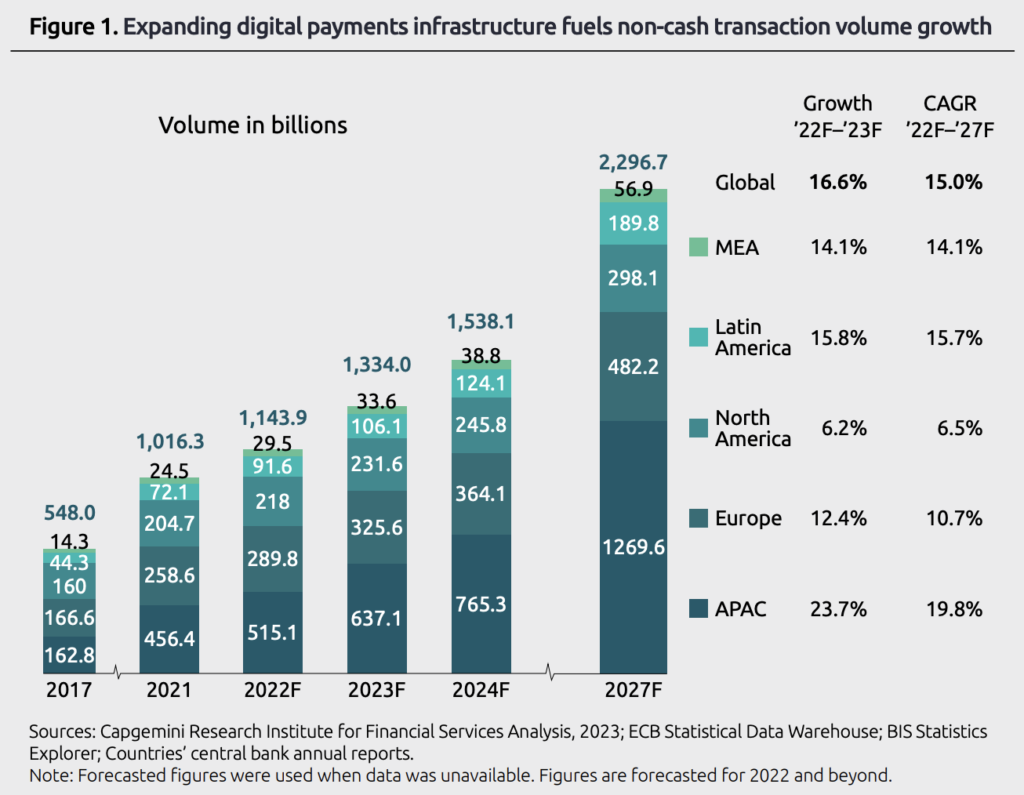

– Non-cash transactions have displayed resilience, with an expected 15% CAGR growth from 2022 to 2027. This growth is attributed to improved macroeconomies, the expansion of digital payment infrastructure, and the proliferation of new payment instruments.

2. Dynamics of Innovation, Regulation, and Profit

– Despite challenges such as high inflation, declining consumer confidence, and supply chain disruptions, the volume of non-cash transactions is projected to reach nearly 1.3 trillion by 2023, a year-on-year growth of 16.6%.

– Regulations, changing customer expectations, and industry initiatives are driving the rapid adoption of new instruments and instant payments.

– Banks and payment companies must rebalance their focus between retail and commercial payments to maximize value. Commercial payments account for 56% of the total transaction value, compared to 44% for retail payments.

– Risk management, regulatory compliance, and scheme compliance costs make up 36% of total costs for payment companies. Traditional revenues, such as fund revenues (37%), float revenues (13%), and fee-based revenues (29%), are under pressure due to the growing adoption of instant payments and regulatory changes.

3. Corporate Treasury Management

– Treasury management remains a constant challenge for businesses facing macroeconomic headwinds and uncertain growth.

– 79% of CFOs report extended cash conversion cycles, and 70% believe that bank treasury management services are inadequate.

– Banks face numerous challenges in delivering effective treasury management services, including slow integration processes, unsatisfactory bank connectivity, and inaccurate cash forecasting.

4. Partnership Strategies

– To succeed in digital transformation in transaction banking, banks must commit to high-level engagement, consistent planning, and a unified objective for structural reforms.

– 67% of bank leaders acknowledge that strategic partnerships with corporate clients reduce the threat of disintermediation by FinTechs. 57% of payment leaders believe that strategic banking partners benefit from increased cross-selling and upselling opportunities through these relationships.

5. Regional Trends

– Europe: Expected annual compound growth of 10.7% from 2022 to 2027 due to the expansion of instant payments and regulatory enhancements.

– North America: Non-cash payment volume growth is projected at 6.5% CAGR from 2022 to 2027.

– Asia-Pacific: The region is expected to represent over 50% of the global non-cash payment volume with a 19.8% CAGR from 2022 to 2027.

– Middle East and Africa: Expected growth is 14.1% CAGR from 2022 to 2027.

– Latin America: Projected non-cash volume growth at 15.7% CAGR from 2022 to 2027.

In conclusion, the report highlights the opportunities and challenges faced by global payment industry players. Banks and payment companies must adapt quickly to market developments to remain competitive and meet changing customer needs.”